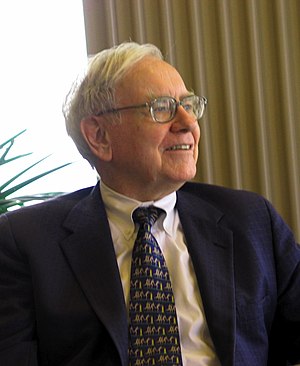

Warren Buffett speaking to a group of students from the Kansas University School of Business (Photo credit: Wikipedia)

It is noteworthy that Warren Buffett, one of the principal investors of our era, has turned his investment attention to solar energy. Even if you do not follow the markets you, likely know are familiar with Warren Buffett. Whether it is from the fact that he was the world’s richest man for an impressive period of time or from frequent discussion regarding his famous frugal lifestyle or his witty comments on our nation’s politics, you know two things about him, namely, he is very rich and incredibly successful. As one could imagine, these two things go hand in hand. Mr. Buffett accomplished this by becoming, “arguably the greatest value investor the world has ever seen. His investment holding company, Berkshire Hathaway (NYSE: BRK.A), has averaged a compounded annual gain of 19.8% since 1964”.[1] When Mr. Buffet speaks, the world listens, and when he takes action, we take heed. Mr. Buffet is known, in particular, for his style of investment, the long haul. He will take large positions in companies and hold them for a long time. When Mr. Buffet decides to purchase stock in a company, he is not looking to make a few quick dollars. He is looking for something with inherent value that he feels is undervalued and can produce long term success. That is why many ears perked when it was announced that, “Mr. Buffet’s MidAmerican Energy Holdings Company has acquired two SunPower solar photovoltaic power plant projects in California for between $2 billion and $2.5 billion. The adjacent Antelope Valley Solar Projects will be built in Los Angeles and Kern counties and will generate 579 megawatts of electricity for utility Southern California Edison. At peak output that’s the equivalent of a big fossil fuel power plant”.[2]

To understand why Mr. Buffet made this purchase, we only need to look at one of his recent purchases and to abroad to understand the future he sees. Let us first look at Mr. Buffet’s purchase of Burlington North Santa Fe Railway in February 2010. When they looked at the railroad industry they saw that, “fuel prices were up 120% since the March 2009 lows[,] unemployment stubbornly hovered around 9% in most areas[,] [and] shipping rates, as measured by the Baltic Dry Index, were 1/10th of their 2008 highs”.1 Many people enjoy quoting FDR’s line, “we have nothing to fear but fear itself”, but do not grasp the context of the words. We recognize the meaning behind the words but tend to fail to see the world to which they were spoken. They were words spoken in the thralls of the Great Depression, reaching out to a world in the grip of compounding fear. Fear, like many traumatizing forces, tends to have a multiplier effect and a perceivable impact on outcomes. People were living in a world where there did not seem to be a light at the end of the tunnel, but what they failed to recognize is that they were the ones who had to dig to the light. Mr. Buffet not only recognized that the light was there, but also comprehended what was necessary to reach that light. Now he is reaping the rewards: “the freight railway industry is enjoying its biggest building boom in nearly a century…Profit in the industry has doubled since 2003, and stock prices have soared…Fortune has even dropped a “green” gift in the industry’s lap. A train can haul a ton of freight 423 miles on a gallon of diesel fuel, about a 3-to-1 fuel-efficiency advantage over 18-wheelers, and the railroad industry is increasingly promoting itself as an eco-friendly alternative”.[3] What we have found buried in this purchase is a sound decision that showed vision and an in-depth understanding of the intersection of both environmental concerns and the drive for profit. How successful was this purchase for Mr. Buffet? In the first nine months of 2012, BNSF accounted for roughly a quarter of Berkshire’s profits. To put that in context, Berkshire owns roughly eighty companies.[4] When Mr. Buffet undertook this purchase, he followed the wisdom of his own words: “‘In business I look for economic castles protected by unbreakable ‘moats.’’”1 Now he turns his gaze to the solar industry, and to understand why, we must turn our gaze abroad.

We turn to Germany which has been making waves lately with its energy reports. Their numbers from this past summer show us why Mr. Buffet was attracted towards solar:

“Renewables now account for 25 percent of energy production, up from 21 percent last year, the country’s energy industry association (BDEW) said in a statement that reinforced Germany’s position as a leader in green technology…Solar energy saw the biggest increase, up 47 percent from the previous year”.[5]

Germany is no small fish; it is a member of the G8 and has a GDP of $3.479 trillion, with a GDP per capita of $42, 625.[6] As such, Germany is quite comparable and offers a viable alternative for America. As of 2011, renewables only accounted for 9% of US energy consumption, with solar only accounting for 2% of that.[7] Unfortunately for the renewables sector, there are many barriers to entry into the energy market in America. Most notable are the huge subsidies given to fossil fuel companies that artificially lower prices. Despite these obstacles, renewables are making inroads. Science has for the most part always been on their side but now the economics are beginning to adjust as well with, “the cost of PV modules, currently the single largest part of system cost, and [falling] 74% in the last twenty years”.7

Still, however, one must question Mr. Buffet’s wisdom. Why would he invest in solar, which makes up such a small percentage of an already small percentage, when he could invest in oil? Oil, already, accounts for 36% of total US energy consumption 7 and the US is set become a net energy exporter in the next few years.[8] Mr. Buffet recognizes that despite the fact oil production is on the rise, we are no longer simply paying prices based on our demand, but on world demand. As such, we no longer solely determine the price.

So then what do we make of Mr. Buffet’s decision? Mr. Buffet, in my opinion, merely did what he has always done. He saw an undervalued industry that has room for growth and decreasing costs. With his purchase he bought a company which not only, “will build and operate the projects for MidAmerican Renewables, and the energy will be sold to Southern California Edison in accordance with two long-term agreements that have received approval from the California Public Utilities Commission”[9], but will print the blueprint of a way forward in America. Germany has already shown us that despite the common argument, it is possible to put yourself on a renewable energy track, while maintaining a high standard of living. We have a castle for a model, but we still need the moats. The moats, of course, are the inherent failures of the fossil fuels, both economically and environmentally. People enjoy stability and control in their lives, and a country whose energy consumption is reliant on fossil fuels can expect neither. In the end, we are left with an industry with growing demand and shrinking costs. Furthermore, we have an administration that has made its support for renewables crystal clear. Mr. Buffet is in this for the long haul and in the long haul, the sun is always going to be there. Warren Buffett clearly recognizes the economic value of investing in alternative energy that helps us live green, be green.

By Sean Patrick Maguire

__________________

[1] http://www.investmentu.com/warren-buffetts-railroad.html

[2] http://www.forbes.com/sites/toddwoody/2013/01/02/warren-buffett-in-2-billion-solar-deal/

[3] http://www.dispatch.com/content/stories/business/2008/04/30/railroads.ART_ART_04-30-08_C8_5RA29I0.html

[4] http://blogs.star-telegram.com/dfwjobs/2012/11/bnsf-continues-to-be-a-profit-leader-for-berkshire-hathaway.html

[5] http://www.reuters.com/article/2012/07/26/germany-renewables-idUSL6E8IQIA720120726

[6] http://www.gfmag.com/gdp-data-country-reports/268-germany-gdp-country-report.html#axzz2Hh9Mj2kK

[7] http://css.snre.umich.edu/css_doc/CSS03-12.pdf

[8] http://www.aljazeera.com/indepth/features/2013/01/20131514160576297.html

[9] http://inhabitat.com/warren-buffet-buys-worlds-largest-solar-plant-for-just-over-2-billion/

SunPower Corporation (Photo credit: Wikipedia)